“Supply and demand has never been in better balance,” Kris Miller told the more than 100 guests at Ackerman & Co. 11th Investor Conference, recently held in Atlanta.

He added that the ongoing strong demand for product – and lack of overbuilding in sectors such as office during this cycle – puts Atlanta in position to be a leading market for investors in 2018 and beyond.

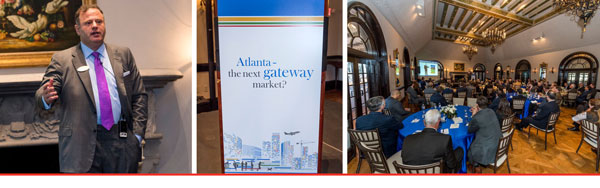

The company’s annual Investor Conference is an opportunity for Ackerman & Co. to provide perspective on trends in commercial real estate and for guests to network with leading owners, operators, investors and capital sources.

Conference themes are sometimes broad in scope but this year the focus was squarely on the Atlanta market as Kris Miller addressed the question: Atlanta – the Next Gateway Market?

Atlanta lacks the land constraints, barriers to entry or “24/7” attributes of established gateway cities such as New York, Chicago, San Francisco and Boston. Yet, Miller added, Atlanta’s diversified economy, success at attracting corporate relocations and growth as an entertainment hub are bringing it closer to the status of a gateway market.

Together with his partner F. Keene Miller (President, Brokerage) and Leo Wiener (President, Retail), Brett Buckner (SVP, Industrial), John Willig (Principal) and Evan Ziegler (SVP, Investment), the speakers offered insights into the investment climate in the office, industrial, retail and medical office sectors.

Some highlights from this year’s conference:

- Economic drivers including the 2017 tax plan and the easing of numerous regulations are likely to free up money for capital investment and boost demand for CRE space.

- The continued strong performance of the Atlanta industrial sector – which posted 19.9 million square feet of absorption in 2017 and is experiencing historically low vacancy levels – puts Atlanta’s growth potential ahead of the top 4 industrial markets (New York/New Jersey, Los Angeles, Chicago, Dallas).

- Fundamentals weakened slightly in the office sector in 2017, but there are still excellent investment opportunities for the right property in the right location across Atlanta’s office submarkets.

- Although the retail sector is out of favor amid store closings, “brick and mortar is not dead” and good retail product is available but at high cap rates.

- Strong demographics continue to fuel investment in medical office space, as does the heightened demand for “convenience” medical space located near retail.

Kris and the team enjoyed hosting the conference and look forward to seeing everyone again next year!